How To Use Apple Pay in 2024 ? A Complete Guide

We are living in an increasingly cashless world. From store checkout lines to sending money to friends, digital payments are becoming the norm. Apple Pay has emerged as a significant player in this mobile payment revolution. But what exactly is Apple Pay, and how does it work? In this guide, we’ll provide a comprehensive overview of Apple’s contactless payment system – its history, functionality, security, benefits, and more.

What is Apple Pay?

Apple Pay was officially launched in October 2014 in the United States. The goal was to replace traditional credit and debit cards by allowing users to pay in stores, apps, and online using their Apple devices.

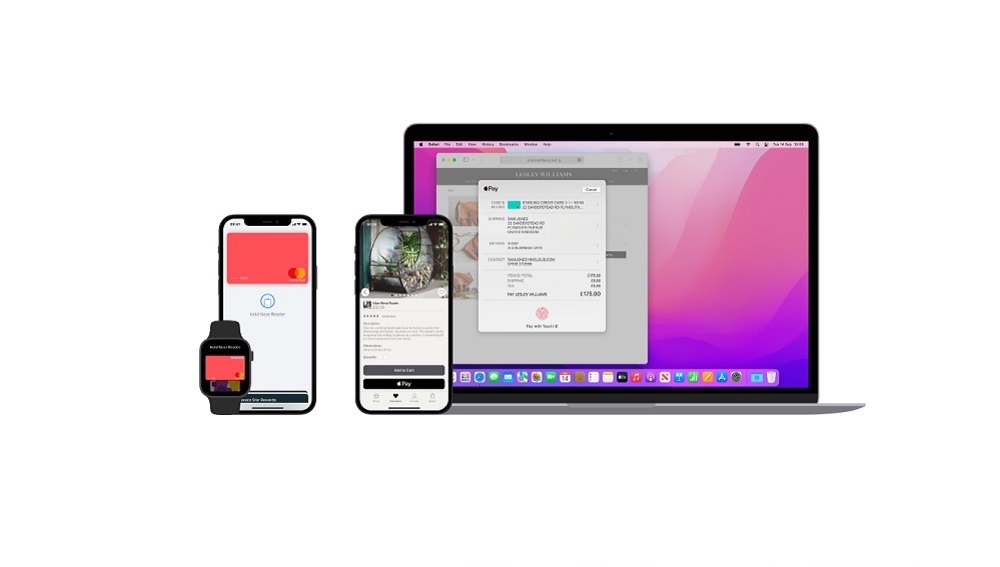

To use Apple Pay, you need an iPhone 6 or later model, an Apple Watch, or a supported iPad or Mac paired with an Apple ID. Over the years, Apple has rapidly expanded Apple Pay to more countries, banks, and merchants. As of 2023, Apple Pay is accepted in nearly 70 countries worldwide.

How Does Apple Pay Work?

Apple Pay combines NFC technology, biometric authentication, tokenization and other encryption methods to enable mobile payments that are both seamless and secure for users.

- Near Field Communication (NFC): Apple Pay utilizes NFC technology to transmit payment data between the device and the payment terminal. When you hold an iPhone or Apple Watch near the contactless reader, NFC allows the two devices to communicate securely.

- Secure Element: A dedicated chip inside Apple devices stores encrypted payment credentials and transaction-specific security keys. The Secure Element helps protect the payment information and cryptographic keys.

- Touch ID/Face ID: Apple Pay uses biometric authentication through fingerprint or facial recognition technology. This ensures that only you can approve payments from your devices.

- Tokenization: When you add a card to Apple Pay, the actual card number is not stored on the device or Apple servers. Instead, a unique Device Account Number is created, encrypted, and assigned to your device. This one-time token allows payments without exposing your card details.

- Apple Pay Servers: These verify your identity, process tokenized transactions, and link the tokens to your actual accounts for payment. The servers connect to payment networks like Visa, Mastercard, and American Express to finalize transactions.

- Wallet: The Wallet app allows you to conveniently add, view and manage debit, credit cards, and rewards cards for Apple Pay.

- Apple Pay JS: This allows developers to integrate Apple Pay into websites and apps for in-app purchases and online checkout.

How to set up Apple Pay?

Step 1: Check if your device supports Apple Pay. You’ll need an iPhone 6 or newer model, an Apple Watch, or a supported iPad to use Apple Pay. On iPhones, make sure you’re running iOS 8.1 or later. You’ll also need Touch ID or Face ID enabled on your device.

Step 2: Add a compatible credit or debit card. Open the Wallet app on your iPhone or iPad. Tap the “+” icon in the top right and select “New Card”. You can then use your device’s camera to scan or enter your card details manually. Make sure your card issuer supports Apple Pay.

Step 3: Verify your card. Your bank will verify your card details and terms. This may involve additional steps like entering a one-time code sent to your phone. Once verified, your card will appear in your Wallet, ready for use.

Step 4: Set up security. To authenticate payments, you’ll be prompted to add a passcode, Touch ID, or Face ID. This adds an essential layer of protection for Apple Pay transactions.

Step 5: Start paying for in-store purchases. Hold your iPhone near the contactless reader with your finger on Touch ID. An Apple Watch can also be held near the reader to pay. Confirm payments on the Apple watch by double-clicking the side button.

Step 6: Manage your cards. You can add, remove or edit cards anytime in the Wallet app. Tap a card, scroll down and select “Remove Card” to delete it from Apple Pay. To change details, tap the card, press “Edit”, and update as needed.

That’s it! With just a few quick steps, you can enjoy the convenience of Apple Pay. Use it for everyday shopping, bills, transportation and more.

Also, see the YouTube video guide for how to use Apple Pay below:

Is Apple Pay Secure?

Apple Pay utilises multi-layered security measures, including biometric authentication and encryption, to keep user data safe. Your credit card details are never stored on your device or shared with merchants. Instead, each transaction uses a unique one-time security code, with purchases authorized via Face ID, Touch ID or passcode. This ensures your card number stays private and payments remain secure when using Apple Pay.

Benefits of Using Apple Pay

Apple Pay offers convenience, speed, rewards, and privacy. You can pay quickly with your Apple device, accumulate credit card points, redeem special Apple Pay offers, and rest assured that your payment details stay private. Purchases aren’t tracked or stored by Apple, adding peace of mind.

Where Can You Use Apple Pay?

Apple Pay is widely accepted for one-touch checkout at most major retailers, stores, restaurants, transit systems, and online. Any merchant that accepts contactless payments from Mastercard, Visa, Amex or Discover will take Apple Pay. You should look for the contactless logo at checkout and hold your compatible iPhone, Apple Watch, or iPad near the reader to pay. Apple Pay also works within apps and games for in-app purchases.

The Future of Apple Pay

As contactless payments keep rising globally, Apple Pay is poised to benefit significantly from its early leadership. Apple continues to expand the service across new markets and add features, leveraging its substantial global device footprint and focus on security. Though adoption challenges and competition with services like Google Pay persist, Apple Pay maintains key advantages that position it for potentially massive growth in mobile payments.

Conclusion

Apple Pay has fundamentally changed how we pay in stores, online, and within apps. It offers a secure, private, and convenient way to purchase using your Apple devices instead of cards. As contactless payments keep rising, Apple Pay will reshape commerce and payments for the next generation.

So next time you’re out shopping and see the Apple Pay logo at checkout, give it a try. You may be surprised at how seamless and liberating it feels compared to digging through your Wallet for a credit card. Apple Pay takes mobile payments to the mainstream – and this is just the beginning.